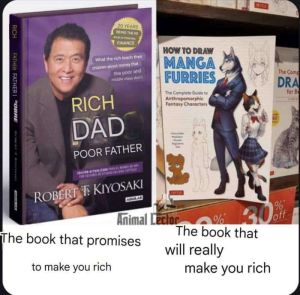

Rich Dad Poor Dad

Rich Dad Poor Dad: Summary and Main Criticisms

Summary:

- Central Idea: Challenges traditional views on wealth creation, arguing that working for money alone won't make you rich. Instead, it advocates for financial literacy, building assets (businesses, investments), and understanding financial statements.

- Key Lessons:

- Financial education: Importance of learning about financial concepts beyond traditional schooling.

- Assets vs. liabilities: Differentiating between income-generating assets and debt-accumulating liabilities.

- Financial independence: Aiming for wealth creation over high income through various means like businesses and investments.

- Overcoming fear: Recognizing and overcoming fear of failure and financial risk.

Main Criticisms:

- Oversimplification: Critics argue the book presents complex financial concepts in a simplistic way, potentially misleading readers.

- Lack of nuance: The book's generalizations about rich and poor people and their financial habits are seen as inaccurate and insensitive.

- Cherry-picking evidence: Anecdotal stories are used to support claims, lacking broader data and research to validate the advice.

- Promotion of risky ventures: Encouragement to invest in riskier assets like real estate without emphasizing the potential for significant losses.

- Downplaying traditional education: The book's message about the limitations of traditional education can be discouraging and inaccurate for certain career paths.

Overall:

Rich Dad Poor Dad offers some valuable financial insights and encourages readers to break free from conventional thinking. However, its oversimplifications, lack of nuance, and potential to mislead require readers to approach it with a critical eye and conduct further research before implementing its advice.

It's important to remember that personal finance is complex and individual circumstances vary greatly. While the book can be a starting point for financial education, it shouldn't be considered a definitive guide or replace professional financial advice.

Reality Check

It's interesting to consider the potential reality check you mentioned regarding the author of Rich Dad Poor Dad being $1 billion in debt. Here are some points to ponder:

Possible Criticisms:

- Hypocrisy: If the author truly understood and practiced the financial principles advocated in the book, how could they end up in such significant debt? This raises questions about the book's effectiveness and the author's credibility.

- Overlooking risk: The book's emphasis on risk-taking and unconventional strategies might not have adequately addressed the potential for substantial losses. This highlights the importance of responsible risk management and diversification in financial planning.

- Real-world application: The book's concepts might not translate well to all readers' situations. Individual circumstances and risk tolerance vary greatly, and what works for one person might not work for another.

Alternative Perspectives:

- Learning experience: The author's experience could be seen as a valuable lesson in the complexities of financial markets and the importance of adaptability. It might serve as a cautionary tale about the potential pitfalls of excessive leverage and overconfidence.

- Evolving strategies: The financial landscape is constantly changing, and strategies that were successful in the past might not be as effective today. The author's debt could be attributed to outdated methods or unforeseen market shifts.

- Limited disclosure: Without more details about the specific circumstances surrounding the author's debt, it's difficult to draw definitive conclusions. There might be extenuating factors or nuances to the story that aren't publicly known.

Overall:

The author's debt situation raises valid concerns about the book's real-world applicability and potential for misleading readers. However, it's crucial to consider all sides of the story and avoid oversimplification.

Remember, financial advice should always be tailored to individual circumstances and risk tolerance. It's important to consult with qualified professionals before making significant financial decisions based on any single source of information.