Socialized Losses

Socialized Losses: The Achilles’ Heel of Capitalism

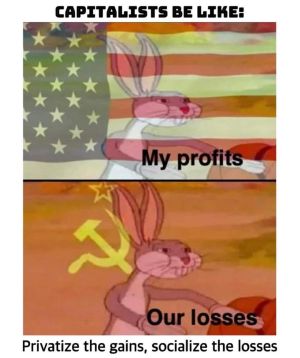

"Our Profits, Socialized Losses."

This unspoken mantra of corporate America perfectly encapsulates one of the biggest flaws of capitalism: privatized gains and publicized losses. The idea is simple—when businesses thrive, the profits go to shareholders and executives, but when they fail spectacularly, the financial burden is dumped onto the public.

This phenomenon, known as socialized losses, is not just an unfortunate side effect of capitalism—it is an intentional feature exploited by corporations, particularly in industries deemed "too big to fail." Nowhere was this more evident than in the 2008 subprime mortgage crisis, where reckless banking practices led to the largest financial collapse since the Great Depression. Millions of Americans lost their homes and jobs, while the very institutions responsible for the disaster received trillions in government bailouts.

How Socialized Losses Work

At its core, socialized losses occur when private companies take risks to maximize profits but shift the consequences of failure onto society. This happens in various ways:

- Government Bailouts – When corporations fail due to their own reckless decisions, the government steps in with taxpayer money to rescue them.

- Too Big to Fail – Large financial institutions engage in risky behavior knowing that they will be saved if things go south.

- Moral Hazard – When businesses are repeatedly bailed out, they have no real incentive to act responsibly, leading to a cycle of financial crises.

- Hidden Costs to Society – While banks and corporations get direct government support, the real burden falls on ordinary people through lost jobs, reduced wages, and economic instability.

The Subprime Mortgage Crisis: A Case Study in Socialized Losses

The 2008 financial meltdown is the textbook example of socialized losses at work. It all started when banks began issuing risky subprime mortgages—loans given to people who couldn’t afford them. These bad loans were then repackaged and sold as "safe" investment products.

At first, everyone made money—banks, investors, and mortgage brokers. But when borrowers inevitably defaulted, the entire system came crashing down. The response? The federal government bailed out the very institutions that caused the crisis.

- The Troubled Asset Relief Program (TARP) injected $700 billion into failing banks.

- The Federal Reserve pumped trillions into the financial system to prevent total collapse.

- Meanwhile, millions of Americans lost their homes and savings—without a bailout.

Winners and Losers of Socialized Losses

- Winners: Banks, hedge funds, Wall Street executives—who received government bailouts and golden parachutes.

- Losers: Taxpayers, working-class Americans, and homeowners—who lost jobs, homes, and financial security.

Moral Hazard and the Inefficiencies of the Free Market

One of the fundamental arguments for capitalism is that bad businesses should fail—forcing the market to self-correct. Yet, when powerful corporations face collapse, the rules suddenly change. Instead of allowing free-market principles to run their course, the government steps in, artificially keeping failed institutions alive.

This creates a moral hazard—a situation where companies take excessive risks because they assume they’ll be bailed out if things go wrong. The result? More reckless behavior, more financial crises, and more economic inequality.

Why Socialized Losses Undermine Capitalism

- Market Inefficiency – A true free market lets bad businesses fail. Bailouts distort competition, allowing reckless firms to survive at the expense of responsible ones.

- Wealth Redistribution (But in Reverse) – Instead of redistributing wealth to the poor, bailouts redistribute taxpayer money to billionaires and corporations.

- No Real Accountability – Executives responsible for financial disasters rarely face legal consequences. They walk away with bonuses, while ordinary people suffer.

- Cycle of Crisis – The same bad behavior repeats, leading to new crises every decade.

The Bigger Picture: Socialized Losses Beyond Banking

The banking industry isn’t the only offender. Socialized losses appear across multiple sectors:

- Big Oil & Climate Change – Fossil fuel companies profit while pollution costs (hurricanes, wildfires, rising sea levels) are borne by taxpayers.

- Pharmaceutical Industry – Drug companies profit from high-priced medicine while taxpayers fund research, development, and subsidies.

- Defense Contractors – Military-industrial companies benefit from endless wars, while the cost of war is paid by soldiers and taxpayers.

What Can Be Done?

To fix this fundamental flaw, real systemic changes are needed:

- Break Up Too Big to Fail Banks – No institution should be so large that its failure threatens the entire economy.

- Strict Regulations on Risky Behavior – Prevent financial institutions from making reckless bets with other people’s money.

- End Bailouts for Corporations – If businesses fail, let them fail. No more taxpayer-funded lifelines.

- Hold Executives Accountable – If bankers commit fraud or cause economic collapse, they should face jail time, not bonuses.

- Invest in the People, Not Just Corporations – If bailouts must exist, direct them to workers, homeowners, and small businesses, not billionaires.

Conclusion: Capitalism’s Greatest Contradiction

Capitalism preaches risk and reward, but in reality, the biggest corporations face no real risk—they get all the reward while passing the losses onto everyone else. Socialized losses undermine the principles of a free market by ensuring that the rich never truly fail.

As long as this system remains unchecked, history will continue repeating itself: profits privatized, losses socialized—with the public paying the price every time.