Perpetual Futures

The Cryptic Connection: Derivatives and Spot Markets in Crypto

The crypto derivatives market and the regular spot market are two sides of the same coin, both are driven by gambling with leverage intricately linked in their price discovery and risk management. Let's understand their relationship and how funding plays a crucial role in balancing the perpetual futures market with the spot market.

Spot Market - Where the Action Begins:

- This is the primary marketplace where you buy and sell actual cryptocurrencies, like Bitcoin or Ethereum. You directly own the crypto you purchase and hold it in your wallet.

- The spot market price sets the base for all other crypto valuations, including derivatives.

Derivatives Market - Hedging Your Bets:

A place where you can make $100 using $1000 capital

See also: MoNoRick and Mawty/S1E5: Perps

- This market deals with contracts based on the future price of the underlying asset (cryptocurrency). These contracts, like futures and options, allow you to speculate on or hedge your exposure to price fluctuations without owning the actual asset.

- Perpetual futures, a specific type of futures contract, are unique because they have no expiry date. You can hold them indefinitely, and their price tracks the spot market with a funding mechanism ensuring convergence.

Funding

Funding - The Balancing Act:

Wojak: You have a whole planet of gamblers sitting around making magic internet money for you? That's slavery. CZ: It's society. They work for each other, Morty. They pay each other. They buy houses. They get married and make children that replace them when they get too old to make power. Wojak: That just sounds like slavery with extra steps.

- Here's where the real magic happens. To keep the perpetual futures price and the spot price in sync, funding payments are exchanged daily between long and short positions.

- If the perpetual futures price is higher than the spot price:

- Longs pay Shorts: Funding rate is positive, and long positions receive payments from shorts. This incentivizes buying in the spot market, pushing the price towards the futures level.

- If the perpetual futures price is lower than the spot price:

- Shorts pay Longs: Funding rate is negative, and short positions receive payments from longs. This incentivizes selling in the futures market, pulling the price down towards the spot level.

By adjusting the funding rate dynamically, the system nudges the perpetual futures price back towards the spot price over time. This ensures that the derivatives market doesn't deviate significantly from reality and serves its purpose of hedging or speculating on the actual asset value.

In a nutshell:

- The spot market defines the base price for cryptocurrencies.

- Derivatives market, particularly perpetual futures, offer sophisticated tools for managing risk and speculation.

- Funding payments act as a self-correcting mechanism, aligning the perpetual futures price with the spot market over time.

Remember, this is a simplified explanation of a complex system. Further research and exploration are encouraged to fully grasp the intricate relationship between the crypto spot market and its derivatives offspring.

| ⚠️ Disclaimer: | The information provided in this text is for educational and informational purposes only. These writings are my own opinion, provided as-is, and has no warranty expressed or implied. None of it is financial, legal, or other professional advice. The author encourages readers to use discretion and make informed decisions regarding their own practices while seeking professional advice if necessary. |

|---|

do not fall for the cartels tricks spot price on these alts is not real and barely does any volume at all compared to perps ok its actually real but because these spot pairs are doing such tiny fractions of the volume of the perps they end up reverting closer to the perp pair than the other way around -JandX, Derivatives trader (Twitter)

This analysis suggests that the spot price of certain altcoins (alternative cryptocurrencies) might not be an accurate reflection of their true market value due to the low trading volume compared to their perpetual futures markets. Here's a breakdown:

Key claims:

- Spot price is not "real": The author believes the spot price doesn't reflect the true market value because of low trading volume.

- Tiny volume compared to perps: Trading on the spot market for these altcoins is significantly lower than on the perpetual futures market.

- Perps drive the spot price: Due to the low volume on the spot market, the price on the perpetual futures market (with higher volume) exerts a stronger influence, pulling the spot price closer to it.

Possible implications:

- Price manipulation: If the perpetual futures market is dominated by large players or cartels (groups manipulating prices), they could potentially influence the spot price indirectly through the funding mechanism mentioned in the previous answer.

- Market inefficiency: Low spot volume suggests a lack of active buyers and sellers, making the price discovery process less efficient and susceptible to manipulation.

- Trading opportunities: Understanding the influence of perps on the spot price could offer arbitrage opportunities for skilled traders.

However, it's important to consider:

- Data: The analysis doesn't specify which altcoins or data sources are being used. Different coins and exchanges might have varying volume discrepancies.

- Regulation: Crypto markets are largely unregulated, and manipulation or cartels are potential concerns. However, exchanges employ various measures to mitigate these risks.

- Other factors: Spot price can also be influenced by factors like news, investor sentiment, and on-chain data, not just by perpetual futures.

In conclusion:

This analysis raises interesting questions about the relationship between spot and perpetual futures markets in low-volume altcoins. While the spot price might not always be entirely "real", understanding the dynamics at play can be valuable for informed trading decisions and assessing potential market inefficiencies. It's crucial to conduct your own research and consider other factors beyond this specific analysis before making any investment decisions.

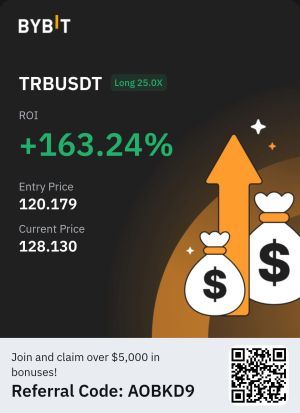

Why %ROI can be misleading

It's true that %ROI can be very misleading when it comes to perpetual futures, and here are some key reasons why:

1. Leverage: Unlike traditional spot trading, perpetual futures employ leverage, amplifying both profits and losses. A seemingly high %ROI could be the result of using high leverage, which magnifies small price movements but exposes you to significant risk if the market goes against you.

2. Funding Rate: Perpetual futures contracts constantly adjust their price to converge with the underlying asset's spot price. This adjustment occurs through a funding rate, which essentially charges or pays traders depending on their position (long or short). Depending on the market sentiment and funding rate, a high %ROI might not represent actual profit earned but rather the impact of funding payments.

3. Cost of Carry: If holding a long position in a perpetual futures contract, you might incur storage or borrowing costs for the underlying asset. These costs eat into your returns and should be factored into the actual %ROI achieved.

4. Impermanent Loss: In certain cases, especially for perpetual futures tracking decentralized finance (DeFi) assets, impermanent loss can occur. This happens when the price of the underlying asset diverges from the price of the perpetual futures contract due to liquidity differences. This can significantly impact your actual returns, even if the %ROI number appears high.

5. Ignoring Fees: Trading platforms charge various fees for opening, closing, and holding positions in perpetual futures. These fees need to be deducted from the %ROI calculation to accurately reflect your true profitability.

Example: Imagine a 5% price increase in a perpetual futures contract with 10x leverage. This might translate to a 50% ROI. However, if the funding rate charges 0.2% daily and you hold the position for 5 days, the funding cost alone would eat into your profits by 1%. Additionally, if platform fees are 0.1% per trade, your actual ROI shrinks to 48.9%.

Therefore, focusing solely on %ROI in perpetual futures can be dangerous. Always consider leverage, funding rates, cost of carry, impermanent loss, and fees for a realistic picture of your returns.

Technical Description

Imagine a casino so big that it doesn’t just take bets on slot machines or blackjack—it lets you bet on literally everything. Stocks, crypto, commodities, even foreign exchange rates. Now imagine that this casino never closes, never sleeps, and has no limits on how much you can borrow to gamble.

Congratulations. You’ve just entered the world of perpetual futures.

Perpetual futures are one of the most popular and dangerous trading instruments in modern finance. They’re called "perpetual" because unlike traditional futures contracts, they never expire—which means the game never stops. You can go long (betting the price goes up) or short (betting it goes down), but no matter what side you pick, there’s always one universal rule:

The house always wins.

How Perpetual Futures Became a Global-Scale Casino

Unlike normal investing, where you buy an asset and wait for it to appreciate, perpetual futures let you bet on the price direction without owning anything. It's a zero-sum game—every winner is paid with a loser's money.

And just like any good casino, the house (whales, market makers, and exchanges) has a few tricks up its sleeve to ensure the small fish always lose in the long run.

Leverage: The Ultimate Double-Edged Sword

The biggest attraction of perpetual futures? Leverage.

Most exchanges allow you to trade with 10x, 50x, or even 100x leverage—meaning if you have $1,000, you can control a position worth $100,000. This sounds amazing—until you realize that even a 1% price move can completely wipe you out.

💀 The reality:

- Low leverage (1x-5x) – You're just making small directional bets, which is almost like normal investing.

- Medium leverage (5x-10x) – Now you’re gambling, but still have a chance of survival.

- High leverage (50x-100x) – You’re basically in a Vegas casino putting your life savings on red or black.

In the short term, over-leveraged traders are guaranteed to be liquidated—which is why the whales love to manipulate the market to hunt stop-losses.

How Whales Manipulate the Market to Liquidate Both Sides

If you think perpetual futures are just a fair game of buyers vs. sellers, you’re not thinking like a whale. The real money isn’t made by picking a side—it’s made by liquidating everyone else.

📌 Common Whale Tactics:

🔪 Stop Loss Hunting:

- Whales look for clusters of stop-loss orders and liquidations (because they’re visible on order books).

- They push the price into these zones to wipe out retail traders, then reverse the price back to normal.

🔄 The "Bart" Formation:

- Sudden, unnatural spikes followed by a flatline, then an instant return to the original price.

- It looks like a Bart Simpson haircut on the charts and is used to trap both longs and shorts.

📉 Cascading Liquidations:

- If enough people are leveraged long, the whales dump the price to liquidate them all at once.

- Liquidations trigger automatic sell orders, causing a chain reaction of stop-outs that accelerate the price drop.

- Once retail traders are wiped out, the whales buy at the bottom and send the price back up.

Whales don’t care about fundamentals or technical analysis—they trade based on where the most liquidations are.

Trading Psychology: Why Humans Are Hardwired to Lose

Most people lose money trading not because they’re dumb, but because they’re human.

📌 Common Psychological Pitfalls:

🤡 Overconfidence:

- After a few good trades, traders start believing they’re geniuses.

- They increase leverage and size until the market slaps them back to reality.

🚀 FOMO (Fear of Missing Out):

- "Oh no, it's pumping! I have to buy now!"

- Buying after a pump is like showing up late to a party where all the drinks are already gone.

⏳ Revenge Trading:

- Losing money triggers an emotional response.

- Instead of taking a break, traders double down trying to "win it back"—which usually ends in complete disaster.

🪦 Ignoring Risk Management:

- A smart trader risks 1-2% of their portfolio per trade.

- A dumb trader goes all-in on one bet and gets liquidated.

The market feeds on emotions, and the best traders learn to control theirs.

Is It Gambling?

Yes, if you’re over-leveraged and don’t manage risk, you’re gambling. But if you use proper strategies—low leverage, risk management, and patience—it can be a profitable skill.

🚀 How to Trade Perps Without Gambling:

- Use low leverage (1x-3x) or none at all.

- Risk only what you can afford to lose.

- Set stop-losses and take-profits before entering a trade.

- Trade based on strategy, not emotions.

But let’s be real—most people won’t do this. Because humans love the thrill of "turning $100 into $10,000" overnight. And the whales love taking advantage of that.

Final Thoughts: The Casino Always Wins

Perpetual futures are one of the most predatory financial instruments ever created. They exploit human psychology, encourage reckless risk-taking, and are intentionally designed to transfer money from the majority (retail traders) to the minority (whales and market makers).

But that doesn’t mean you can’t beat the game.

- The key is understanding the rules and not playing like a typical gambler.

- Stay unemotional, use proper risk management, and think like a whale.

Because in the world of perpetual futures, you’re either the prey or the predator. Choose wisely. 🚀