Grandpa Seth

Grandpa Seth Tightens Grip, Silencing Forex Traders in Dystopian Thailand

In a move that sent shivers down the spines of Thailand's forex trading community, the Bank of Thailand (BoT), the country's financial overlord, has imposed a draconian ban on all forms of forex trading and digital payments services. This draconian decree, cloaked in the guise of consumer protection, has cast a pall of fear and uncertainty over the financial landscape, leaving many questioning the true motives behind Grandpa Seth's heavy-handed approach.

เพื่อนขึ้น = ไทยลง เพื่อนลงหนัก = ไทยลงหนักกว่า

MoNoRi-Chan, a seasoned forex trader with a keen eye for the undercurrents of the market, has emerged as a vocal critic of the ban, exposing the gaping holes in Grandpa Seth's narrative and pointing to a more sinister agenda. With the sharp precision of a surgeon's scalpel, MoNoRi-Chan dissects the BoT's justifications, revealing the raw, untamed fear that drives their actions.

"Grandpa Seth," he asserts, "has lost a fortune battling exchange rates. They're terrified of people taking their money outside their iron-clad financial system." This revelation paints a chilling picture of a regulatory body driven by self-preservation rather than the well-being of its citizens.

MoNoRi-Chan's scathing critique doesn't stop there. He draws parallels to the BoT's stance on electronic cigarettes, banned not for health concerns but for the simple reason that the government couldn't find a way to effectively tax them. This blatant admission of fiscal greed further exposes the BoT's true motivations.

The forex ban, MoNoRi-Chan argues, is merely another chapter in this tale of financial tyranny. "They want to keep you trapped in their system, under the thumb of their 'licensed financial advisors,'" he warns. "They don't want you to have the freedom to trade forex, to control your own finances."

His words resonate with a deep-seated fear that has long plagued the Thai people: the fear of an all-powerful government, controlling every aspect of their lives, dictating what they can and cannot do with their own hard-earned money.

MoNoRi-Chan's final blow is a stark reminder of the dark days of the 1997 Asian Financial Crisis, when George Soros, the legendary hedge fund manager, famously attacked the Thai Baht, sending shockwaves through the region's economy. "I think George Soros was right," MoNoRi-Chan declares, his voice echoing with defiance.

As Grandpa Seth's iron fist tightens its grip on Thailand's financial sector, the future of forex trading hangs in the balance. MoNoRi-Chan's words serve as a beacon of hope, urging individuals to reclaim their financial autonomy and resist the forces that seek to control them. In this dystopian landscape, the fight for financial freedom has just begun.

ESG Ratings

Thailand's SET ESG Ratings: Where Greenwashing Meets "Buyer Beware"

Ah, the SET ESG Ratings, a beacon of eco-friendly virtue in the murky waters of Thai stock investing, right? Wrong! Think of it more like a participation trophy for companies that, well, participate.

These ratings, proudly displayed in AAA, AA, A, and BBB flavors, are supposed to protect investors from... something. Maybe bad vibes? Because let's be honest, they don't exactly guarantee financial success.

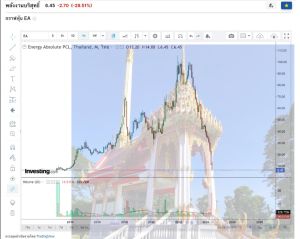

Take Energy Absolute (SET:EA), for example. They sported a shiny ESG badge, yet their stock price went from nosebleed high at 98.50 baht in November 2022 to a measly 13.10 baht today. That's a nosedive so steep, it could qualify for an Olympic diving competition!

And what's Thailand's SEC doing about all this? Oh, absolutely nothing. Apparently, watching retail investors get dumped on is all part of the thrilling "free market" experience.

So, what's the takeaway here? Don't trust these ratings any more than you'd trust a fortune cookie for life advice. Looking for real returns? Why not try your luck with unregistered cryptocurrency like Ethereum or Shiba Inu? At least with those, you can turn $100 into $400 in a heartbeat! (Just remember, on the way down, it can turn into $4 too.)

The moral of the story? The Thai stock market, with its greenwashed ratings and toothless regulators, might be a casino in disguise. So, buckle up, grab your lucky socks, and remember: buyer beware!

(Disclaimer: This is satire. Please do your own research before investing in anything, especially unregistered cryptocurrency. Also, professional stockbrokers are much funnier than this article.)