Thanks for Playing

"Thanks for Playing": A Crypto Eulogy in Three Acts

Ah, the bittersweet "Thanks for Playing" screen. Usually reserved for failed attempts at Donkey Kong or rage-quitting Candy Crush, it's taken on a whole new meaning in the thrilling world of cryptocurrency. Here, we explore this tragic message through the lens of recent rug pulls:

Exhibit A: The Bridge to Oblivion

"The unofficial bridge is now down. gg thanks for playing." This isn't your average "Server Error" message. This, my friends, is the eulogy for your investment. Imagine pouring your hard-earned cash into a project promising to be the "Ethereum killer," only to find the developers vanish like rogue pixels in a glitching game. Here, "gg" (good game) takes on a new, hollow meaning, a sarcastic farewell to the game you never knew you were playing – the Crypto Hunger Games.

Exhibit B: Photon Ph Phishing Your Portfolio

"Photon robs your points. Thanks for Playing (idk)." This cryptic message hints at a project so shady, it doesn't even understand its own demise. "Photon" – the supposed harbinger of technological advancement – has become the villain, siphoning your precious coins into the developer's digital pockets. The "(idk)" is the icing on the scam cake, a blatant admission of incompetence from the very people entrusted with your financial future. Thanks for playing, indeed. But what exactly were we playing? Roulette with our life savings?

Exhibit C: The Price That Keeps on Falling

"Um it's .79 and it stopped? Taengz (another victim): thanks for playing, it's 0.25 now." This exchange paints a picture of a community descending into despair. The initial confusion – "um it's .79?" – quickly morphs into the horrifying realization of a plummeting price. Taengz, a fellow soldier in this financial warzone, offers a grim condolence: "Thanks for playing, it's 0.25 now." The "game" continues, but the only winner is the faceless developer, cackling maniacally behind their anonymous avatar.

These are just a few examples of how "Thanks for Playing" has become the unofficial anthem of the crypto-rug-pulled. A constant reminder that the lines between games and risky financial ventures can be heartbreakingly thin. So, the next time you consider investing in a revolutionary new coin with a website designed by a high schooler, remember: the only "playing" you might be doing is a rather expensive game of chance. Unless, of course, you're the one pulling the rug. But that's a story for another day, and another gullible investor.

Case Study: Energy Absolute (SET:EA)

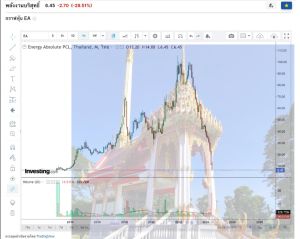

Exhibit D: The Thai Crematorium Pattern

Just when you thought the crypto world held the championship belt for rug-pulling, buckle up for a ride on the Bangkok Bump with the Thai Crematorium Pattern (known to its victims as the "เมรุ"). Take a good look at the image [insert image description here]. This isn't a monument to the dearly departed, it's a tombstone for your investment in Energy Absolute (EA), a company that went from ESG darling to dumpster fire faster than you can say "stock market manipulation."

EA: The Poster Child for Greenwashing Gone Wrong

EA used to be a shining example of sustainable energy... or at least that's what their ESG AA rating would have you believe. But then reality reared its ugly head, along with a 3 billion baht mismanagement scandal and a possible default on their corporate bonds. Their stock price followed suit, plummeting harder than a durian fruit off a skyscraper – from a lofty 110 baht to a measly 6.45 baht. That's a drop that would make even Satoshi Nakamoto weep.

Regulated Stock Exchanges? More Like a Free-for-All Casino

This, my friends, is the true insult to injury. This whole debacle exposes the underbelly of "regulated" stock exchanges – apparently, they're just as susceptible to rug pulls as the Wild West of cryptocurrency. So much for investor protection. Looks like the only regulation happening here is the regulation of how much money you can lose.

ESG: The Revoker, Not the Preventer

And let's not forget about ESG, the supposed guardians of environmental and social responsibility. Where were they when EA was busy cooking the books? Oh right, revoking their AA rating after the whole thing went south. Talk about closing the barn door after the horses have bolted (and then some).

The Moral of the Story? Buyer Beware (Especially in Thailand)

This whole fiasco is a cautionary tale for anyone considering investing in Thailand, or anywhere for that matter. Do your research, don't trust fancy ratings or certifications, and maybe consider keeping your savings tucked under your mattress – at least you'll know exactly where they are. Because in the end, the only guarantee in the world of investment seems to be that "Thanks for Playing" will be the soundtrack to your inevitable financial woes.