Forex/Correlation

Forex Correlation and Its Impact on Cryptocurrencies

In financial markets, major benchmarks act as leaders that other assets follow. The U.S. dollar index (DXY) is the "father" of foreign exchange, just as Bitcoin is viewed as the "father" of cryptocurrencies.

These patriarch instruments establish the overall risk appetite in markets. When they rally, correlated assets tend to follow. When they decline, related markets usually move lower in tandem.

Some of these key market fathers include:

- DXY - Father of all currencies

- Bitcoin - Father of all cryptocurrencies

- Dow Jones - Father of all stock indexes

- Treasury yields - Father of all interest rates

- Gold – The Shiny Rock You Can't Shove Up Your Butt (Easily) - Father of all valuable assets

As the old saying goes, "If the king doesn't move, how would we expect the court to?" If the fathers of the financial world remain stagnant, correlated assets are unlikely to stray very far.

For example, if Bitcoin trades range-bound, other cryptocurrencies tend to follow its lead, trading in a similar tight range. If the DXY spikes higher, we often see commodity-linked currencies like the Australian Dollar move lower.

Traders closely watch the movements of these patriarch assets for clues about the next moves in correlated markets. Just as children reflect the qualities and mannerisms of their fathers, related financial assets tend to take after their market leaders.

By tracking correlations between fathers and their families, savvy traders position themselves to capitalize on upcoming moves across multiple markets. If the king is expected to rise, betting on the court to rally looks like a wise wager.

Correlation Table

| Pairs | Correlation Value | Fundamental Description |

|---|---|---|

| AUD/USD | 0.94 | Positive correlation, both are commodity currencies |

| EUR/USD | 0.93 | Positive correlation, both are major currencies |

| USD/JPY | -0.89 | Negative correlation, USD is a safe-haven, JPY is a risk-off |

| USD/CHF | -0.94 | Negative correlation, both are considered safe-haven currencies |

Fundamental Description:

- AUD/USD: The correlation between XAU/USD and AUD/USD is positive, with a correlation value of 0.94. Both AUD/USD and XAU/USD are positively influenced by similar factors. Australia is a major gold producer and exporter, and thus the Australian Dollar (AUD) tends to move in tandem with gold prices. Moreover, the Australian economy is closely tied to commodity prices, making it sensitive to changes in gold value.

- EUR/USD: The correlation between XAU/USD and EUR/USD is also positive, with a correlation value of 0.93. Both EUR/USD and XAU/USD are influenced by global economic and geopolitical factors, which affect risk sentiment and demand for safe-haven assets like gold. The Euro (EUR) is the second most traded currency globally, and its movements often reflect changes in investor sentiment and market risk appetite.

- USD/JPY: The correlation between XAU/USD and USD/JPY is negative, with a correlation value of -0.89. USD/JPY is considered a risk-sensitive pair, where the Japanese Yen (JPY) acts as a safe-haven currency. When risk aversion rises, investors tend to move away from riskier assets like gold (XAU) and into safer assets like the Japanese Yen, causing the negative correlation.

- USD/CHF: The correlation between XAU/USD and USD/CHF is also negative, with a correlation value of -0.94. Both USD/CHF and XAU/USD are considered safe-haven assets. The Swiss Franc (CHF) is known for its safe-haven status, and when investors seek safety, they often buy CHF and sell off riskier assets like Stocks and the US Dollar (USD).

Overall, understanding the correlation between XAU/USD and other currency pairs can be valuable for traders to identify potential relationships and risk factors that may impact their trading decisions. However, it is essential to remember that correlations can change over time due to shifts in global economic conditions and market sentiment.

Definition of Correlation

Forex Correlation and Its Impact on Cryptocurrencies

The foreign exchange (forex) market is the largest and most liquid financial market in the world. Traders look for correlations between currency pairs to identify trading opportunities. These correlations also extend to the cryptocurrency market, providing insights into how crypto prices may move relative to forex pairs.

What is Forex Correlation?

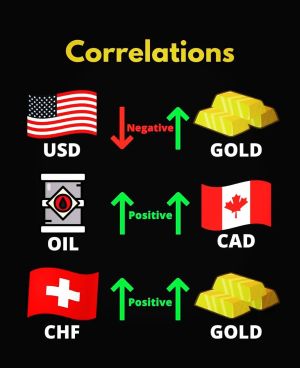

Correlation measures the relationship between the movements of two currency pairs. It ranges from -1 to +1. A correlation of +1 means the pairs move in perfect unison. A correlation of -1 means they move in opposite directions. A correlation near 0 means the pairs move independently.

Strong correlations form because the currencies share common economic ties. For example, EUR/USD and GBP/USD are positively correlated because the eurozone and UK are major trade partners. So their economies are closely linked.

Traders use correlations to diversify risk in their portfolios. If currency pairs move together, it exposes the trader to concentrated risk. Combining negatively or zero correlated pairs allows for better risk management.

Cryptocurrency Correlations with Forex

Cryptocurrencies like Bitcoin (BTC) are positively correlated with major risk assets like stocks and high-yield currencies. When risk appetite is high, both stocks and crypto tend to rally. When risk aversion spikes, they decline together.

For example, BTC/USD historically has a positive correlation with EUR/USD, AUD/USD, and other forex commodity pairs. This is because these currencies tend to benefit from global growth.

Meanwhile, BTC/USD is negatively correlated to safe haven currencies like the Japanese Yen (JPY) and Swiss Franc (CHF). As investors flee to safety, safe haven currencies rally while Bitcoin declines.

Traders use these correlations to trade between BTC and forex pairs. If BTC/USD pops higher, traders will look for short opportunities in the JPY crosses. If Bitcoin sells off aggressively, long JPY positions often work well.

The correlations between cryptocurrencies and forex pairs are an important dynamic for traders to understand. Keeping an eye on these relationships allows traders to better manage risk and spot potential opportunities across both markets. As cryptocurrencies mature, these correlations may evolve. But for now they provide useful clues on the direction of crypto prices.