Cryptocurrency/Selling

| ⚠️ Disclaimer: | The information provided in this text is for educational and informational purposes only. These writings are my own opinion, provided as-is, and has no warranty expressed or implied. None of it is financial, legal, or other professional advice. The author encourages readers to use discretion and make informed decisions regarding their own practices while seeking professional advice if necessary. |

|---|

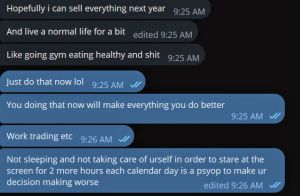

I sold everything I had. Every coin I owned is gone. I'm completely out of the cryptocurrency market, I can't take it anymore. Aggressive dumping, manipulation, everything is so intense. crypto is over, I am out, I am very glad to meet you, life has dreams, each is wonderful.

Cashing Out Your Crypto: Turning Coins into Cold, Hard Bills

So, you've been riding the crypto wave and your portfolio is looking bullish. Congratulations! But at some point, you might want to cash out some of those digital gains and turn them into real-world dollars (or your local currency). Here's a breakdown of the most common ways to convert your crypto to cash:

1. Cryptocurrency Exchanges:

- This is the most popular and straightforward method. Major exchanges like Conbase, Binance, Kraken, or Gemini allow you to sell your cryptocurrency for fiat currency (USD, EUR, etc.) and then withdraw it to your bank account.

- Pros: Easy to use, secure platforms, familiar interface for most.

- Cons: Fees can vary depending on the exchange and the amount you're cashing out. Transaction times might apply for withdrawing to your bank. Supported countries may vary.

2. Peer-to-Peer (P2P) Marketplaces:

- Platforms like Binance P2P or Bybit P2P connect you directly with other individuals who want to buy your crypto. You agree on a price and payment method (bank transfer, cash deposit, etc.) and execute the trade.

- Pros: Potentially lower fees compared to exchanges, greater flexibility in payment methods.

- Cons: Higher risk of scams. Requires more caution and verification of the other party before trading.

3. Crypto ATMs:

- These physical ATMs allow you to sell your crypto for cash on the spot.

- Pros: Fast and convenient, no need for an exchange account.

- Cons: Extremely high fees compared to other methods, limited availability (not as widespread as regular ATMs).

4. Using a Debit Card with Crypto Support:

- Some crypto companies offer debit cards that allow you to spend your crypto holdings directly like a regular debit card. Transactions are converted to fiat currency at the point of sale.

- Pros: Convenient for everyday purchases, eliminates the need for selling beforehand.

- Cons: Limited selection of providers, fees may apply depending on the card and transaction. Availability depends on your jurisdictions.

5. Brokerage Firms Offering Crypto Services:

- Some traditional brokerage firms like Robinhood have started offering cryptocurrency trading. This allows you to sell your crypto and transfer the funds to your existing brokerage account.

- Pros: May be convenient for investors already using a brokerage platform, potential tax advantages depending on your location.

- Cons: Not all brokerages offer crypto yet, fees might be higher compared to dedicated crypto exchanges. Also you don't own the keys to your coins.

Important Considerations:

- Taxes: Remember, selling crypto for cash might have tax implications depending on your location. Always consult a tax professional for guidance.

- Security: Choose reputable platforms and marketplaces with strong security measures. When using P2P platforms, be extra vigilant against scams.

- Fees: Compare fees before using any service to maximize your profits.

By understanding these methods and their pros and cons, you can choose the best approach to cash out your crypto and secure your well-earned gains. Remember, diversification is key, so consider using a combination of these methods depending on your needs and risk tolerance.

OTC Story

The air pulsed with the feverish energy of a bull run. Crypto charts were painted a glorious green, and news feeds blared tales of overnight millionaires. At the dining table that evening in my Khon Kaen Story Arc, My friend's aunt, usually skeptical of all things digital, hovered nervously, clutching her phone. A recent convert to the crypto craze, she was so happy that amassed a surprising little fortune and now the word 'cash-out' danced in her eyes.

(The conversation at the dining table starts with various coin topics) Lex: Hey sis, you have some SHIB right? They just jumped 200% in the past few days. Lex's Sister: Yeah, I still holding it since few years ago. Lex's Mom: At least while we're in profit, Why don't you sell some and take the money out? Lex's Sister: I only have 'nance account But P2P markets are full of scams (Continued conversation about cashing out and how to use P2P)

From P2P marketplaces, with their whispers of scams and shady deals, terrified her. That's when I, MoNoRi-Chan, the resident crypto geek of the family, stepped in. It was time to impart a basic lesson of the bull market: take some profits, or you'll just be swimming in circles, eternally chasing those imaginary numbers on screen. What I do here is "Dealing OTC"

Step by step, I guided her through the withdrawal process. Starting by moving her Tether, those realized gains locked in stablecoins, flowed from her exchange wallet into my exchange's deposit address. Numbers blinked on the screen, potent symbols of potential.

Then came the magic moment. I hit 'sell', converting that sea of stablecoins into a very real, very satisfying pile of fiat. Relief washed over her face as I handed her the cash equivalent, a tangible manifestation of her crypto adventure.

"Always remember, Aunt," I said, echoing a Wall Street adage, "if you don't take some profits off the table, all that 'wealth' is just numbers on a screen."

She smiled, a newfound glint in her eye. The fear had dissipated, replaced by a sense of quiet triumph. Perhaps I'd even converted her into a believer of 'partial profits' – a valuable lesson in this volatile, thrilling world of cryptocurrency.