Regret: Difference between revisions

MoNoLidThZ (talk | contribs) |

Grassstation (talk | contribs) No edit summary |

||

| Line 1: | Line 1: | ||

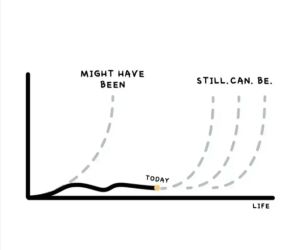

[[File:Life Decisions.jpg|thumb|Life decisions can be full of regrets... ]] | |||

The River of [[Time]]: Embracing Action and Leaving Regret Behind | The River of [[Time]]: Embracing Action and Leaving Regret Behind | ||

This article talks about the human feeling of '''Regret'''. We grapple with concepts like fate and free will, yearning for the ability to glimpse the future. [[Wojak|We]] imagine ourselves buying that winning lottery ticket number, scooping up [[Bitcoin]] at a measly $20, or making that oh-so-obvious decision that would have changed everything. | This article talks about the human feeling of '''Regret'''. We grapple with concepts like fate and free will, yearning for the ability to glimpse the future. [[Wojak|We]] imagine ourselves buying that winning lottery ticket number, scooping up [[Bitcoin]] at a measly $20, or making that oh-so-obvious decision that would have changed everything. | ||

Latest revision as of 01:29, 25 April 2024

The River of Time: Embracing Action and Leaving Regret Behind

This article talks about the human feeling of Regret. We grapple with concepts like fate and free will, yearning for the ability to glimpse the future. We imagine ourselves buying that winning lottery ticket number, scooping up Bitcoin at a measly $20, or making that oh-so-obvious decision that would have changed everything.

But here's the stark reality: hindsight is 20/20. The river of time, unlike our stock charts, only flows in one direction. We can't turn back the clock and rewrite choices. Dwelling on "what ifs" and "should haves" only steals our present moment and casts a shadow over our future.

Instead, let's embrace the power we truly possess – the power of action. We may not predict the exact twists and turns on the market chart, but we can choose to invest. We may not see the winning lottery numbers, but we can choose to work towards our financial goals.

Think of the candlestick chart, a visual representation of time's relentless march. While future price movements may be unclear, one thing is certain: the chart will continue its journey to the right. Similarly, our lives, limited to roughly 4,000 weeks, are precious journeys with an uncertain destination.

Don't settle for "almost" or "could have been". Here's how to break free from the shackles of regret:

- Focus on the Present: Stop dwelling on the past and worrying about the future. Channel your energy into proactive decisions that impact your current circumstances.

- Embrace Calculated Risks: While recklessness is unwise, calculated risks are essential for growth. Don't let the fear of "what if" paralyze you from taking meaningful steps towards your goals.

- Learn from Every Move: Every experience, even a perceived mistake, holds valuable lessons. Analyze your past decisions, identify areas for improvement, and move forward with newfound wisdom.

Remember, the future is not set in stone. It's a canvas awaiting your brushstrokes. Take action, make informed decisions, and learn from your experiences. By embracing the present and focusing on the journey, you can rewrite the narrative of your life, leaving regret behind and paving the way for a future filled with possibilities.

Start today. The river of time waits for no one.

รู้อะไรไม่สู้รู้งี้

"รู้อะไรไม่สู้รู้งี้" (Knowing Now Is Better Than Knowing Then): A Trader's Lament and Call to Action

The proverb "รู้อะไรไม่สู้รู้งี้" resonates deeply with the realities of trading and exploring our daily life itself. This Thai saying translates roughly to "Knowing what I know now would've been better than not knowing at all". It speaks to the bittersweet feeling that comes with hindsight, of looking back and wishing we had possessed earlier insights or taken different actions.

For many, the desire to become a successful trader is met with the harsh statistic that 90% of traders lose money. This daunting figure can foster a sense of paralysis, where being overly risk-averse becomes the most risky financial decision of all. Fear of market volatility can lead to missed opportunities and the slow erosion of buying power due to inflation.

While hindsight offers valuable lessons, it's far more empowering to arm ourselves with knowledge and strategies now. Here's how to break free from the "รู้อะไรไม่สู้รู้งี้" cycle and navigate the trading landscape with greater confidence:

- Invest in Yourself: The greatest asset any human can possesses is knowledge. Dedicate yourself to understanding what you already have knowledge in. For example in trading is market dynamics, financial instruments, risk management techniques, and the psychology of trading. Numerous resources are available, from books and online courses to reputable mentors.

- Practice and Patience: Trading mastery doesn't happen overnight. Start with a demo account to hone your skills without risking real capital. Embrace a mindset of continuous learning and adjust your strategies as needed.

- Calculated Risks, Not Fear: Risk is inherent in trading, but calculated risks taken with informed strategies are far less likely to lead to catastrophic losses. Develop a risk management plan tailored to your tolerance levels.

- Self-Directed Investing: Don't surrender your financial future to the whims of others. Learn to manage your investments, conduct your own research, and make informed decisions aligned with your financial goals. Seek advice from qualified professionals when necessary, but always empower yourself with knowledge.

By embracing a proactive approach to learning and investing, we can mitigate the "should have known better" feeling and transform our financial journeys. The market doesn't guarantee success nor he will be merciful for new investors, but knowledge, strategy, and calculated risk-taking offer far greater odds than inaction and regret.

Let's all choose the path of "knowing now" so that our futures are filled with greater confidence and financial freedom.

ถึงแม้ว่าจะรู้อะไรไม่สู้รู้งี้ แต่ก็ดีกว่าไม่รู้อะไรเอย เพราะยังไง ง ย่อมมาก่อน ฉ เสมอ...