Unit (Currency)

De-Dollarization and BRICS’ New Weapon: "The Unit"

The U.S. dollar has long enjoyed its status as the global reserve currency, but the tides are shifting. In recent years, we've seen a growing movement towards De-Dollarization, with countries seeking alternatives to the dollar-dominated financial system. Leading this charge is the BRICS coalition—Brazil, Russia, India, China, and South Africa—who have unveiled a powerful new tool in their arsenal: “The Unit.”

| ⚠️ Disclaimer: | The information provided in this text is for educational and informational purposes only. These writings are my own opinion, provided as-is, and has no warranty expressed or implied. None of it is financial, legal, or other professional advice. The author encourages readers to use discretion and make informed decisions regarding their own practices while seeking professional advice if necessary. |

|---|

What is "The Unit"?

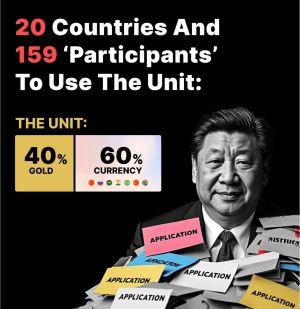

"The Unit" is a new hybrid currency developed by BRICS nations as a direct challenge to the U.S. dollar’s hegemony. It is a strategic blend of 60% currencies from BRICS member states and 40% gold. This design not only stabilizes the currency through gold’s historical role as a store of value but also allows for a higher degree of economic sovereignty for the participating nations. In contrast to the fiat-backed dollar, which is susceptible to inflation and the whims of central banks, "The Unit" is anchored by the collective economic power of the BRICS countries and the solidity of gold.

But this isn’t just a speculative experiment; 20 countries have already signed on to adopt "The Unit," with 159 participants in total—including institutions, corporations, and other entities—ready to integrate it into their financial ecosystems. As the momentum behind "The Unit" grows, the fate of the U.S. dollar hangs in the balance.

A New Weapon in the Currency War

The creation of "The Unit" is more than just a financial tool—it's a geopolitical statement. By reducing their reliance on the U.S. dollar, BRICS nations are effectively insulating themselves from American monetary policy and economic sanctions. The war in Ukraine, coupled with Western sanctions on Russia, has accelerated this trend. Countries like China and India, with their enormous populations and growing economic power, are increasingly motivated to diversify away from the dollar, and the advent of "The Unit" provides them with the perfect vehicle to do so.

The introduction of "The Unit" is part of a broader global trend of De-Dollarization, as many countries seek alternatives to the dollar-based system in order to shield themselves from currency volatility, sanctions, and the dollar's loss of purchasing power due to inflation. By backing part of "The Unit" with gold, the BRICS nations are appealing to those who seek the stability of hard assets in uncertain economic times.

The Dollar's Dominance at Risk

This new currency could deal a significant blow to the dollar's dominance. The U.S. dollar's status as the world’s reserve currency gives the U.S. government immense leverage over global trade, as most international transactions—from oil to raw materials—are conducted in dollars. But with BRICS nations and their allies shifting toward "The Unit," the dollar’s position as the global currency of choice is under siege. The rise of "The Unit" also marks a growing multipolar world where the U.S. may no longer dictate the rules of the global economy.

Moreover, with economic uncertainty looming in the U.S. due to upcoming elections and other internal factors, investors may shy away from risky bets on the dollar. As political instability rises and debt continues to balloon, the markets may enter a risk-off mode, where investors seek safe havens like gold. "The Unit," with its 40% gold backing, presents itself as a potentially attractive alternative to the dollar, especially in a world where trust in fiat currencies is rapidly eroding.

The Unit and a New Financial Order

The success of "The Unit" will likely depend on how many nations and economic entities embrace it. If more countries align themselves with the BRICS coalition, the global financial system could see a significant shift away from U.S. dollar dominance. Countries in Latin America, Africa, and Asia that are tired of the constraints and vulnerabilities of the current dollar-based system could see "The Unit" as a pathway to greater economic independence.

Furthermore, the strategic mix of gold and BRICS currencies makes "The Unit" a formidable weapon. Gold’s enduring stability lends credibility to the currency, while the inclusion of BRICS currencies ensures that the economic powerhouses of the developing world are represented. In an era where fiat currency volatility is rampant and faith in central banks is waning, the appeal of a gold-backed hybrid currency like "The Unit" is undeniable.

The Future of the Global Economy

As "The Unit" gains traction, the implications for the global economy are profound. For decades, the U.S. dollar has been the anchor of the global financial system, but the winds of change are blowing. De-Dollarization is no longer a distant theory but a tangible reality as countries around the world look for alternatives to the dollar.

The BRICS coalition has made a decisive move to challenge U.S. dominance in global finance, and the creation of "The Unit" marks a new chapter in this struggle. With more countries expected to adopt this new currency, the balance of economic power could shift dramatically in the coming years. The U.S. dollar is facing its greatest challenge yet, and its future as the global reserve currency is far from guaranteed.

For now, the financial world watches closely as the BRICS countries and their allies pave the way toward a new monetary order. Whether "The Unit" will dethrone the dollar remains to be seen, but one thing is clear: the age of dollar dominance is in jeopardy, and a new era of multipolar currencies may soon take its place.