The Big Short

Plot Synopsis of The Big Short

Adapted from Michael Lewis' book, The Big Short (2015), directed by Adam McKay, is a satirical yet sobering dive into the financial catastrophe of 2008. The movie follows a ragtag group of misfits, eccentric Wall Street outsiders, and an investor collective who bet against the seemingly indomitable housing market—and profit massively when the bubble bursts.

Key Plot Points:

- The Origins of the Short Dr. Michael Burry (played by Christian Bale), a socially awkward hedge fund manager, spots cracks in the foundation of the U.S. housing market. While analyzing mortgage-backed securities, he discovers that subprime mortgages—loans given to people with poor credit histories—are ticking time bombs. Realizing the housing market is built on unsustainable lending, Burry decides to "short" the market by buying credit default swaps (CDS), effectively betting that the system will collapse.

- Skepticism & Paranoia Burry's move attracts attention. Jared Vennett (Ryan Gosling), a self-serving yet savvy bond salesman, sees the potential in Burry's logic and gets in on the action. Along the way, Mark Baum (Steve Carell), a cynical fund manager with a moral streak, is reluctantly dragged into the conspiracy after realizing the scale of Wall Street’s corruption.

- Discovery of Fraud The narrative unfolds as these characters delve deeper into the inner workings of the mortgage-backed security (MBS) market. Baum and his team uncover layers of fraud: from brokers issuing loans to people who can’t afford them, to agencies like Moody’s and S&P rubber-stamping junk bonds as AAA. The system, they realize, isn’t just collapsing—it’s designed to fail for the sake of corporate greed.

- Chaos Ensues Ben Rickert (Brad Pitt), a disillusioned former banker, assists two young investors, Charlie Geller and Jamie Shipley, in joining the bet against the housing market. As the financial crisis looms, panic sets in. Mortgage defaults rise, Wall Street tries to cover its tracks, and ordinary Americans bear the brunt of the collapse.

- The Crash The bubble bursts in 2008. While the protagonists make fortunes from their risky bets, they remain haunted by the human cost. The movie ends with a mix of triumph and melancholy: they’ve proven the system’s corruption, but it’s the average citizens who lose their homes, jobs, and savings.

The Big Short's Perspective on the 2008 Financial Crisis:

- Exposing Systemic Greed The film rips off Wall Street’s mask, showing how systemic greed, negligence, and outright fraud drove the financial crisis. Lenders gave out risky loans, banks packaged them into MBSs, and rating agencies blindly stamped them with high ratings—all to rake in profits. This cascade of irresponsibility was not an accident; it was deliberate.

- Wall Street's Arrogance The movie highlights how Wall Street executives operated with a dangerous mix of arrogance and ignorance. Despite red flags, the market was treated as invincible. When the protagonists shorted the market, they were mocked—until they were proven right.

- Ordinary People as Collateral Damage The Big Short never loses sight of the human cost. Families lose their homes, jobs vanish, and lives are destroyed—all because of decisions made in corporate boardrooms. The anger and frustration of Mark Baum serve as the audience's emotional anchor, forcing viewers to confront the reality that the system sacrifices the many for the wealth of the few.

- A Broken System The film portrays the financial system as fundamentally broken. Even as the crisis unfolds, the people responsible for the collapse face no real consequences. Bailouts save the big banks, but not the homeowners. By the end, nothing has changed—financial institutions continue operating as if nothing happened.

- Dark Humor and Satire Using fourth-wall breaks, celebrity cameos (e.g., Margot Robbie explaining MBSs in a bathtub), and biting humor, the movie makes complex financial concepts accessible while mocking the absurdity of the financial world’s hubris.

Ultimately, The Big Short presents the 2008 crisis as both preventable and inevitable—preventable because the warning signs were ignored, and inevitable because unchecked greed ruled the system. The protagonists profit off the collapse, but the victory is hollow; as Jared Vennett says, “They knew it all along. And they did nothing.”

Post-Big Short Economic Events

Post-2008 Financial Market Analysis: The Fallout and the Evolution

The 2008 financial crisis shattered the illusion of stability in the American financial system. It exposed deep-seated flaws in the regulatory framework, highlighted the dangers of unchecked corporate greed, and forever altered the economic landscape. Let’s analyze the chain of events and their ripple effects:

1. The Aftermath of the Crisis: Bubbles and Bailouts

Bailouts: Too Big to Fail

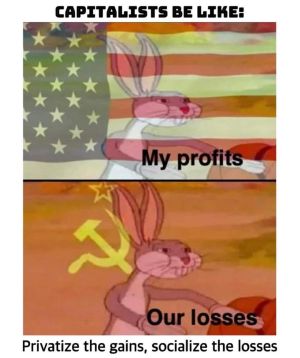

In the wake of the crisis, the U.S. government pumped $700 billion into the economy via the Troubled Asset Relief Program (TARP) to save collapsing financial institutions. Banks like Citigroup, AIG, and others were rescued, while homeowners—who were promised relief—were left with foreclosures and bankruptcy. The public began to question the fairness of a system that socialized losses while privatizing gains.

This bailout culture fostered moral hazard: banks knew they would be saved, creating little incentive to change risky behaviors. The crisis didn’t reform Wall Street; it merely gave it a temporary slap on the wrist.

Quantitative Easing (QE): Inflating New Bubbles

The Federal Reserve injected liquidity into the system through quantitative easing, keeping interest rates near zero. This cheap money policy inflated asset bubbles in stocks, real estate, and corporate debt markets. The wealth gap widened as those with access to capital (the rich) became even richer, while wages stagnated for the middle and working classes.

2. The Rise of Distrust and the Need for Decentralization

Erosion of Trust

Post-2008, public confidence in banks, regulators, and the government plummeted. Institutions designed to safeguard the economy had either failed to act or actively participated in the fraud. The phrase "too big to fail" became synonymous with systemic corruption.

The Birth of Bitcoin (2009)

Bitcoin emerged as a direct response to the 2008 crisis. Its creator, the pseudonymous Satoshi Nakamoto, released the Bitcoin whitepaper in October 2008, shortly after the Lehman Brothers collapse. The first Bitcoin block (Genesis Block) contained the embedded message:

"The Times 03/Jan/2009 Chancellor on brink of second bailout for banks."

Bitcoin offered an alternative:

- Decentralization: No central authority controls Bitcoin, unlike banks or governments.

- Transparency: Transactions are recorded on an immutable blockchain ledger, visible to anyone.

- Scarcity: Unlike fiat currency, Bitcoin has a fixed supply of 21 million coins, designed to prevent inflation.

3. The Evolution of the Financial Landscape (2010-2025)

Post-Crisis Boom and New Risks

- Asset Inflation: The Fed’s low interest rates led to overvalued stock markets and speculative investments.

- Corporate Debt Crisis: Corporations borrowed heavily, creating another bubble that threatened to implode during global crises (e.g., COVID-19).

- Economic Inequality: Wealth remained concentrated at the top, while younger generations faced stagnant wages and crippling student debt.

Bitcoin and Crypto Adoption

Initially dismissed as a niche experiment for tech enthusiasts, Bitcoin gained traction as a hedge against inflation, economic uncertainty, and financial corruption. Key milestones:

- Institutional Adoption (2020s): Companies like Tesla and MicroStrategy began holding Bitcoin on their balance sheets. Financial giants (Fidelity, BlackRock) launched crypto services.

- Global Remittance: Bitcoin became popular for cross-border payments, especially in countries with unstable currencies (e.g., Venezuela, Turkey).

- Digital Gold: Bitcoin became a store of value akin to gold, particularly as central banks printed trillions during the COVID-19 pandemic.

4. Why Bitcoin Seems to Be Winning in 2025

Economic Factors

- Persistent Inflation: Years of money printing by central banks have devalued fiat currencies. Bitcoin, with its finite supply, has become a preferred hedge.

- Banking Failures: Continued bank collapses (e.g., SVB crisis) remind people of the fragility of traditional systems. Trust in decentralized systems has grown.

Technological Superiority

- Decentralized Finance (DeFi): Bitcoin and other blockchain technologies allow individuals to bypass banks entirely. Lending, borrowing, and payments can now occur without intermediaries.

- Lightning Network: Bitcoin’s second-layer solutions have made it faster and cheaper to use, addressing criticisms of scalability.

Geopolitical Shifts

- Global Adoption: Countries like El Salvador have made Bitcoin legal tender, and others are exploring similar policies. In contrast, fiat systems like the U.S. dollar face challenges due to debt crises and declining global influence.

- Economic Sovereignty: Bitcoin empowers individuals and countries to operate outside the influence of centralized powers like the IMF or World Bank.

Cultural Relevance

- Gen Z and Millennials: Younger generations, distrustful of traditional institutions, are driving Bitcoin adoption. To them, crypto represents freedom, transparency, and empowerment.

5. The Broader Implications for Finance

Bitcoin’s rise is emblematic of a larger trend: a shift from centralized, exploitative systems toward decentralized, democratized alternatives. Whether through blockchain, DeFi, or CBDCs (central bank digital currencies), the financial world is transforming.

However, challenges remain:

- Regulatory Pushback: Governments, threatened by Bitcoin’s rise, are ramping up regulation.

- Scalability and Energy Use: Critics argue Bitcoin’s energy consumption and scalability issues need solutions to ensure long-term success.

Conclusion: The Triumph of Decentralization?

In 2025, Bitcoin’s success represents a rebellion against the legacy of 2008: a corrupt financial system designed to benefit the few at the expense of the many. It thrives as a symbol of hope for those disillusioned by Wall Street greed, central bank incompetence, and systemic inequality.

While it’s too early to declare total victory, Bitcoin’s trajectory suggests that the future of finance will belong to systems that empower individuals over institutions—a direct consequence of the 2008 financial meltdown.