Startups

The Startup Balancing Act: Why Great Ideas Aren't Enough

The world of startups is a land of audacious dreams and relentless hustle. But amidst the passionate pitches and disruptive ideas lies a harsh reality: many startups fail. Why? Often, it boils down to a precarious balancing act – the need to juggle customer satisfaction, sustainable business models, and a manageable burn rate.

The Curse of the Burn Rate:

Take Robinhood, the Thai food delivery app that initially charmed users with its zero-commission policy. While the app attracted customers, its lack of revenue coupled with operational costs created a sky-high burn rate – the rate at which it burned through cash. This unsustainable model, despite backing from a major financial group, ultimately led to Robinhood's demise.

Big Tech's Investment Dilemma:

This high-risk environment makes big tech giants like Google, Facebook, and Amazon cautious investors. Stories like Robinhood and Uber, with their astronomical burn rates, raise concerns about the long-term viability of seemingly innovative ideas. Investors need to see a clear path to profitability, and exorbitant spending without a concrete plan for revenue generation raises red flags.

The Trilemma of Startups:

So, what's the secret sauce for startup success? It's the ability to navigate a trilemma:

- Customer Satisfaction: Startups need to offer a product or service that truly solves a problem or fills a gap in the market. Unhappy customers lead to churn and hinder growth.

- Business Money-Making Strategies: A sustainable business model is paramount. Whether it's subscriptions, advertising, or freemium models with premium upgrades, startups need a clear path to profitability.

- Capital Burn Rate (Net Profit): Managing cash flow is crucial. Startups can't afford to burn through money at an unsustainable rate. Finding a balance between customer acquisition and responsible spending is key.

The "Shark Tank" Effect:

Shows like Shark Tank capitalize on this very concept. Budding entrepreneurs pitch their ideas to savvy investors, facing a barrage of questions about their business model, burn rate, and target market. Potential investors assess the trilemma – can this idea translate into a product or service that satisfies customers, makes money, and manages its finances responsibly? In exchange for investment, these "sharks" often take equity in the company, betting on the founders' ability to navigate this precarious balancing act.

The Three-to-Four Year Window:

The fate of a startup often unfolds within a three-to-four-year window. Can they find that elusive "product-market fit" (PMF) – a product that perfectly aligns with customer needs? Can they develop a sustainable revenue stream that outpaces their expenses? The answer to these questions determines whether a startup soars or falls flat.

Conclusion:

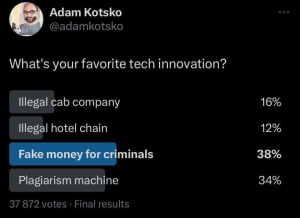

> create startup > raise millions of dollars > spend irresponsibly > be complete asshole to everyone > blow up company > "founder mode"

While audacious ideas are the fuel of innovation, they're just the first step. For startups to thrive, they must master the art of balancing customer satisfaction, smart business models, and responsible spending. It's a tough act, but the rewards for those who nail it can be transformative. As for investors, both big tech giants and showstopping "sharks," they'll remain cautious, waiting for the startups that can prove they've mastered the trilemma and are poised for long-term success.