Brent Crude Oil

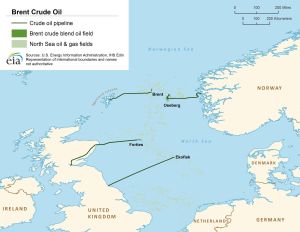

Brent Crude Oil, also known as UK Oil, is a light, sweet crude oil extracted from fields in the North Sea near Scotland. It serves as a major benchmark for global oil pricing, impacting everything from gasoline costs to energy security. However, the potential decommissioning of the Brent pipeline raises concerns about a future supply crisis, particularly for Europe.

MoNoRi-Chan "The Sniper"; a fictitious investor with profitable long positions in Brent and positive swaps, considers the potential impacts of this scenario. However, Mr. Shorts Soros, a bearish investor, posits a different perspective, suggesting a downward trend before the decommissioning and Exxon Mobil's potential exit from the industry. This article explores both sides of the argument, offering a balanced view of the potential consequences.

Scenario 1: Decommissioning Triggers Supply Shock

- Supply disruption: The decommissioning of the Brent pipeline would significantly reduce oil production from the North Sea, leading to a potential supply gap. This could push oil prices upwards, impacting energy costs for consumers and businesses across Europe.

- Geopolitical implications: Europe relies heavily on Brent crude for its energy needs. A supply shortage could exacerbate existing tensions with oil-producing nations, increasing political instability and potentially triggering further price hikes.

- Impact on Long Investors: As a long investor, MoNoRi-Chan would likely benefit from rising prices. However, prolonged instability could lead to market volatility, potentially affecting his swaps and overall position.

Scenario 2: Downward Trend Before Decommissioning

- Market forces: Mr.Shorts Soros argues that existing supply chain issues and the ongoing war may already be putting downward pressure on oil prices. This could lead to a price drop to $62 per barrel before the decommissioning even occurs.

- Exxon Mobil's exit: Mr.Shorts Soros believes that the current market challenges may incentivize major oil producers like Exxon Mobil to exit the industry, further impacting supply and potentially leading to price increases in the long run.

- Impact on Long Investors: If Mr.Shorts Soros's prediction holds true, MoNoRi-Chan could experience losses on his long positions before the decommissioning. However, if the decommissioning triggers a significant price rise later, he could still see profits.

Conclusion:

The potential decommissioning of the Brent pipeline presents a complex scenario with multifaceted consequences. While MoNoRi-Chan, as a long investor, stands to gain from a supply shock, Mr.Shorts Soros's bearish outlook highlights the possibility of a price drop before the event. Ultimately, the actual impact will depend on various factors, including global energy demand, alternative supply sources, and geopolitical developments. Investors like MoNoRi-Chan should carefully consider all potential scenarios and conduct thorough research before making investment decisions.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Please consult with a qualified financial professional before making any investment decisions.