Girl Math

Girl Math: If I buy this and I use it for x times >it will of course pay for itself 💀

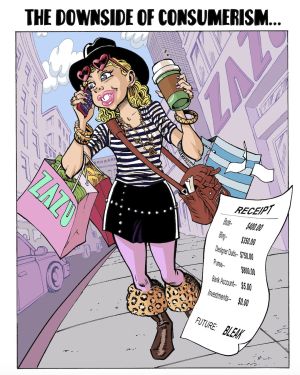

Introducing the latest trend taking TikTok by storm: "Girl Math." In a world where justifying impulsive spending is an art form, influencers are coming together to share their unique perspective on personal finance, and it's all in good fun... or is it?

The concept is simple yet brilliantly convoluted. If you've ever splurged on expensive items, luxurious products, or designer brands, "Girl Math" has got you covered. The equation goes something like this: take the number of times you've used the purchase and divide it by the cost. Voilà! Suddenly, that pricey handbag doesn't seem so expensive anymore because, well, you've used it a bunch of times, right? It's like a mathematical magic trick that makes your wallet woes vanish.

And that's not all. The "Girl Math" trend takes a dive into the world of cold hard cash, where spending money is essentially like scoring freebies. How? Well, according to this unique calculation, if the digits in your bank account haven't decreased, it's almost as if you're not spending money at all. Who cares if you're buying those designer shoes left and right? As long as the number on your statement stays the same, it's like a shopping spree in financial disguise.

Experts, however, are raising eyebrows at this trend. They're concerned that "Girl Math" could lead to even more financial struggles for those lacking basic money management skills. It's akin to rationalizing your way into a money pit, convinced that you're making sound financial decisions when in reality, you're just creating more debt for yourself.

It's as if people are desperately seeking reasons to convince themselves they can afford things they really shouldn't. "Girl Math" is the art of lying to yourself it's okay to spend way beyond your means, all while wrapping it up in a neat little equation. It's the classic case of knowing you shouldn't spend, pretending you can afford it, and amplifying your financial issues in the process.

So, before you fully dive into the "Girl Math" trend, maybe take a moment to reflect on whether those calculations are really adding up or if they're just leading you down a treacherous path of credit card chaos. Just like consuming "fast food" style content on TikTok, it's important to ask yourself: is it really worth it to chase these popular trends? Remember, the allure of viral trends might not last forever, but the financial impact of overspending can have a permanent effect on your financial well-being if you don't budget yourself correctly. As tempting as it might be to use clever equations to justify your spending, it's wise to approach financial decisions with a clear and responsible mindset. After all, the only equation you should be concerned about is one that helps you balance your budget and achieve your financial goals in the long run.

And don't forget, the allure of "Girl Math" and the quick thrill of impulsive spending is not just a trend confined to TikTok. You might have encountered similar scenarios in everyday life, like when your "Women ☕" friend justifies her shopping spree by claiming she's saving money on each individual item, even though her credit card bill tells a different story.

It's all too easy to get caught up in the excitement of the moment and let these justifications cloud your financial judgment. But the truth is, financial decisions, especially those influenced by trends and influencers, should always be made with a level head and a full understanding of your own financial situation. So, before you jump on the "Girl Math" bandwagon or any other financial trend, take a step back, assess your budget, and decide whether it's truly worth sacrificing your financial stability for a fleeting moment of excitement. After all, "likes" might come and go, but the weight of a hefty credit card bill can linger much longer than you'd ever expect.

Comparing Girl Math to Boys Upgrading their PC

| Girl Math Spending Path | Tech Logic PC Upgrades |

|---|---|

| Impulsive purchases without considering financial situation | Calculated decisions based on value and long-term benefits |

| Trendy items with short-lived excitement | Strategic investments for enhanced computing experience |

| Justifications made on the spot | Informed decisions after research and analysis |

| Temporary satisfaction, lasting impact on finances | Lasting value and improved PC performance |

| May lead to overspending and budget issues | Increases productivity and multitasking efficiency |

| May not consider actual needs | Adapts to changing software and technology demands |

| Quantity over quality approach | Quality components for longevity |

| Fulfilling instant gratification | Enhances work and leisure activities |

| May not align with financial goals | Aligns with value and utility for cost savings |

| May regret purchases later | Minimizes buyer's remorse |

| Fashion-focused mindset | Performance-focused mindset |

The "Tech Logic PC Upgrades" approach contrasts with the impulsive spending mindset of "Girl Math," focusing on informed decisions and lasting value. By investing in PC upgrades that enhance performance, productivity, and entertainment, you're making decisions that align with your long-term goals and provide a more satisfying computing experience.

Girl math is being scared of getting pregnant but asking to be creampied 🎀