Debt Treadmill

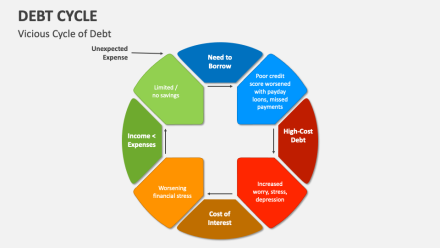

The Debt Treadmill: A Vicious Cycle of Indebtedness

The "debt treadmill" is a term used to describe the cycle of accumulating debt that can be difficult to escape. This cycle is often perpetuated by predatory lending practices, such as those employed by credit card companies.

The Lure of 0% APR Offers

Credit card companies often entice consumers with offers of 0% APR for a limited time. This can be a tempting proposition, especially for those looking to consolidate debt or make a large purchase. However, these offers can be a trap. Once the introductory period ends, the interest rates on these cards can skyrocket, making it difficult to pay off the balance.

The Minimum Payment Trap

Making only the minimum payment on a credit card balance can prolong the debt cycle. This is because a significant portion of the minimum payment goes towards interest, while only a small amount is applied to the principal. Over time, this can lead to a snowball effect, with the balance growing larger and larger.

Debt Selling and Harassment

If a consumer is unable to keep up with their credit card payments, the debt may eventually be sold to a collection agency. These agencies can be relentless in their pursuit of payment, using aggressive tactics such as harassment and threats.

The Impact on Credit Scores

Late payments or missed payments can have a devastating impact on a person's credit score. A low credit score can make it difficult to obtain loans, rent an apartment, or even find a job.

Avoiding the Debt Treadmill

To avoid falling into the debt treadmill, it is essential to be mindful of credit card usage and to develop a responsible financial plan. Here are some tips:

- Use credit cards wisely: Only charge what you can afford to pay off in full each month.

- Avoid carrying a balance: If you must carry a balance, make sure to pay more than the minimum payment.

- Monitor your credit report: Regularly check your credit report for errors and take steps to correct any inaccuracies.

- Consider debt consolidation: If you're struggling to manage multiple debts, debt consolidation can help you simplify your finances.

The Case of Citibank

The story of Citibank closing an account after a single bounced check highlights the predatory practices that can be employed by financial institutions. Such actions can have a significant negative impact on a person's financial life.

Conclusion

The debt treadmill is a vicious cycle that can be difficult to escape. By understanding the tactics used by credit card companies and taking steps to manage your finances responsibly, you can avoid falling into this trap.